Daily

pulse

Daily

pulse

Saturday, Mar 1, 2025

2:47 PM

Daily pulse

Government Unveils New Economic Policy to Address Inflation

Government Unveils New Economic Policy to Address Inflation

Government Unveils New Economic Policy to Address Inflation

POSTED:

POSTED:

POSTED:

February 1, 2025

February 1, 2025

February 1, 2025

BY:

BY:

BY:

Jones Jacob

Jones Jacob

Jones Jacob

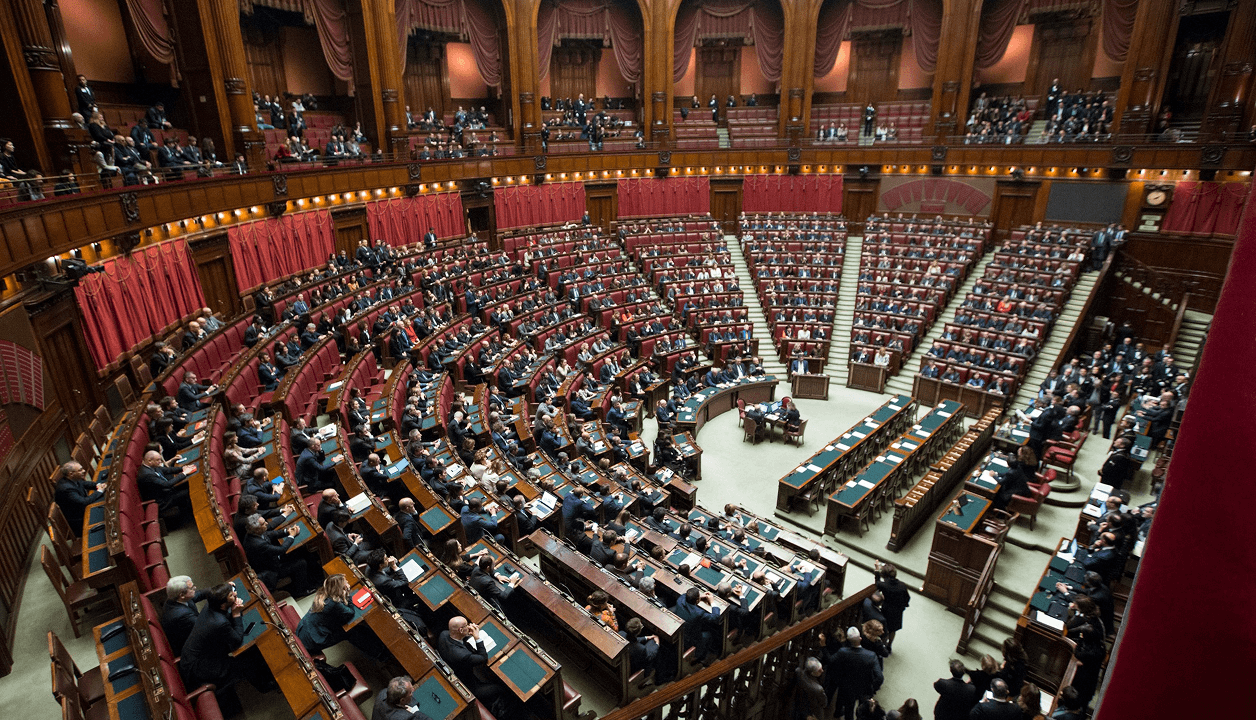

Washington, D.C. — In a decisive move to tackle the nation’s economic downturn, the federal government has introduced a sweeping economic reform policy aimed at curbing inflation, attracting investment, and stabilizing financial markets. The policy was announced at the National Economic Summit, where the Minister of Finance outlined key strategies designed to provide relief to businesses and households struggling with rising costs.

The initiative comes as inflation rates hit record highs, with consumer prices surging across essential goods and services. Over the past year, food prices have jumped by more than 30%, while transportation costs have also skyrocketed, placing additional strain on low-income families. The government’s plan includes several measures designed to ease financial pressure and spur economic growth.

To support businesses, tax reductions will be introduced for small and medium-sized enterprises, while startups in critical industries will receive additional incentives. Businesses earning below a certain threshold will be eligible for corporate tax cuts, and local manufacturers will benefit from temporary tax exemptions. In an effort to attract foreign investors, the government is rolling out tax holidays, duty-free imports for machinery and equipment, and streamlined business registration processes. Officials expect this to increase investments in agriculture, renewable energy, and technology.

In response to concerns about government overspending, stricter budgetary controls will be implemented to reduce wasteful expenditure and prioritize essential projects. Ministries and agencies will be required to adopt cost-cutting measures to curb financial mismanagement. The Central Bank has also announced plans to increase interest rates to stabilize the currency and slow inflation. While experts warn that this could reduce borrowing, officials argue it is necessary to maintain financial stability.

A significant portion of the national budget will be allocated to infrastructure projects, including road construction, energy expansion, and digital transformation. The government anticipates that these investments will generate thousands of new jobs and strengthen economic output. The announcement has sparked divided opinions among economic analysts, business leaders, and the public. Some applaud the government’s proactive measures, while others remain skeptical about the feasibility of these reforms.

"It’s a step in the right direction," said Dr. Adebayo Lawson, a senior economic strategist. "However, execution will be the real test. If the government fails to enforce budget discipline, we could see a repeat of past failures." For small business owners, the tax cuts offer a glimmer of hope. Funke Ajayi, who runs a local manufacturing firm, believes these incentives could allow her company to expand.

"If these policies are properly implemented, businesses like mine will finally get some breathing space," she said. "But we’ve heard similar promises before, so I’ll wait and see." However, critics argue that the reforms do not address wage stagnation and the growing unemployment crisis. With salaries failing to keep up with inflation, many workers are finding it increasingly difficult to afford daily necessities.

Despite the ambitious scope of the policy, several challenges could hinder its success. Bureaucratic delays may slow the rollout of tax reforms and budget controls, while the proposed increase in interest rates may be unpopular among consumers and businesses that rely on loans. With elections approaching, changes in leadership could disrupt or reverse the reforms, and external economic factors such as global financial trends, oil prices, and international trade policies could also impact the effectiveness of domestic policies.

The government has promised quarterly progress updates, with the first major review expected within six months. A task force has been established to monitor implementation and ensure accountability across sectors. As businesses and citizens await concrete results, the success of these reforms will ultimately depend on efficient execution and sustained economic stability. For now, the country watches closely, hoping that these measures will provide relief in an increasingly challenging economic climate.

Washington, D.C. — In a decisive move to tackle the nation’s economic downturn, the federal government has introduced a sweeping economic reform policy aimed at curbing inflation, attracting investment, and stabilizing financial markets. The policy was announced at the National Economic Summit, where the Minister of Finance outlined key strategies designed to provide relief to businesses and households struggling with rising costs.

The initiative comes as inflation rates hit record highs, with consumer prices surging across essential goods and services. Over the past year, food prices have jumped by more than 30%, while transportation costs have also skyrocketed, placing additional strain on low-income families. The government’s plan includes several measures designed to ease financial pressure and spur economic growth.

To support businesses, tax reductions will be introduced for small and medium-sized enterprises, while startups in critical industries will receive additional incentives. Businesses earning below a certain threshold will be eligible for corporate tax cuts, and local manufacturers will benefit from temporary tax exemptions. In an effort to attract foreign investors, the government is rolling out tax holidays, duty-free imports for machinery and equipment, and streamlined business registration processes. Officials expect this to increase investments in agriculture, renewable energy, and technology.

In response to concerns about government overspending, stricter budgetary controls will be implemented to reduce wasteful expenditure and prioritize essential projects. Ministries and agencies will be required to adopt cost-cutting measures to curb financial mismanagement. The Central Bank has also announced plans to increase interest rates to stabilize the currency and slow inflation. While experts warn that this could reduce borrowing, officials argue it is necessary to maintain financial stability.

A significant portion of the national budget will be allocated to infrastructure projects, including road construction, energy expansion, and digital transformation. The government anticipates that these investments will generate thousands of new jobs and strengthen economic output. The announcement has sparked divided opinions among economic analysts, business leaders, and the public. Some applaud the government’s proactive measures, while others remain skeptical about the feasibility of these reforms.

"It’s a step in the right direction," said Dr. Adebayo Lawson, a senior economic strategist. "However, execution will be the real test. If the government fails to enforce budget discipline, we could see a repeat of past failures." For small business owners, the tax cuts offer a glimmer of hope. Funke Ajayi, who runs a local manufacturing firm, believes these incentives could allow her company to expand.

"If these policies are properly implemented, businesses like mine will finally get some breathing space," she said. "But we’ve heard similar promises before, so I’ll wait and see." However, critics argue that the reforms do not address wage stagnation and the growing unemployment crisis. With salaries failing to keep up with inflation, many workers are finding it increasingly difficult to afford daily necessities.

Despite the ambitious scope of the policy, several challenges could hinder its success. Bureaucratic delays may slow the rollout of tax reforms and budget controls, while the proposed increase in interest rates may be unpopular among consumers and businesses that rely on loans. With elections approaching, changes in leadership could disrupt or reverse the reforms, and external economic factors such as global financial trends, oil prices, and international trade policies could also impact the effectiveness of domestic policies.

The government has promised quarterly progress updates, with the first major review expected within six months. A task force has been established to monitor implementation and ensure accountability across sectors. As businesses and citizens await concrete results, the success of these reforms will ultimately depend on efficient execution and sustained economic stability. For now, the country watches closely, hoping that these measures will provide relief in an increasingly challenging economic climate.

More on

More on

politics

politics

View all

View all

Scroll

Back to top

Promote your brand with us! Gain exclusive exposure through our platform.

Promote your brand with us! Gain exclusive exposure through our platform.

Promote your brand with us! Gain exclusive exposure through our platform.

This Advertising Block provides a flexible space for your promotion, allowing you to customize it with your own content, visuals, and calls to action. Highlight your brand, showcase your services, or drive traffic to your projects with ease.

This Advertising Block provides a flexible space for your promotion, allowing you to customize it with your own content, visuals, and calls to action. Highlight your brand, showcase your services, or drive traffic to your projects with ease.

This Advertising Block provides a flexible space for your promotion, allowing you to customize it with your own content, visuals, and calls to action. Highlight your brand, showcase your services, or drive traffic to your projects with ease.

Daily pulse

With a focus on accuracy and relevance, we make it easy to navigate the ever-changing news landscape. Stay ahead with stories that matter, presented in a dynamic and engaging way.

© 2025 Daily Pulse. All rights reserved

Designed & Developed

Daily pulse

With a focus on accuracy and relevance, we make it easy to navigate the ever-changing news landscape. Stay ahead with stories that matter, presented in a dynamic and engaging way.

© 2025 Daily Pulse. All rights reserved

Designed & Developed

Daily pulse

With a focus on accuracy and relevance, we make it easy to navigate the ever-changing news landscape. Stay ahead with stories that matter, presented in a dynamic and engaging way.

© 2025 Daily Pulse. All rights reserved

Designed & Developed

Daily pulse

With a focus on accuracy and relevance, we make it easy to navigate the ever-changing news landscape. Stay ahead with stories that matter, presented in a dynamic and engaging way.

© 2025 Daily Pulse.

All rights reserved

Designed & Developed

Scroll

Back to top